Lessons I Learned From Info About How To Apply For A Loan Online

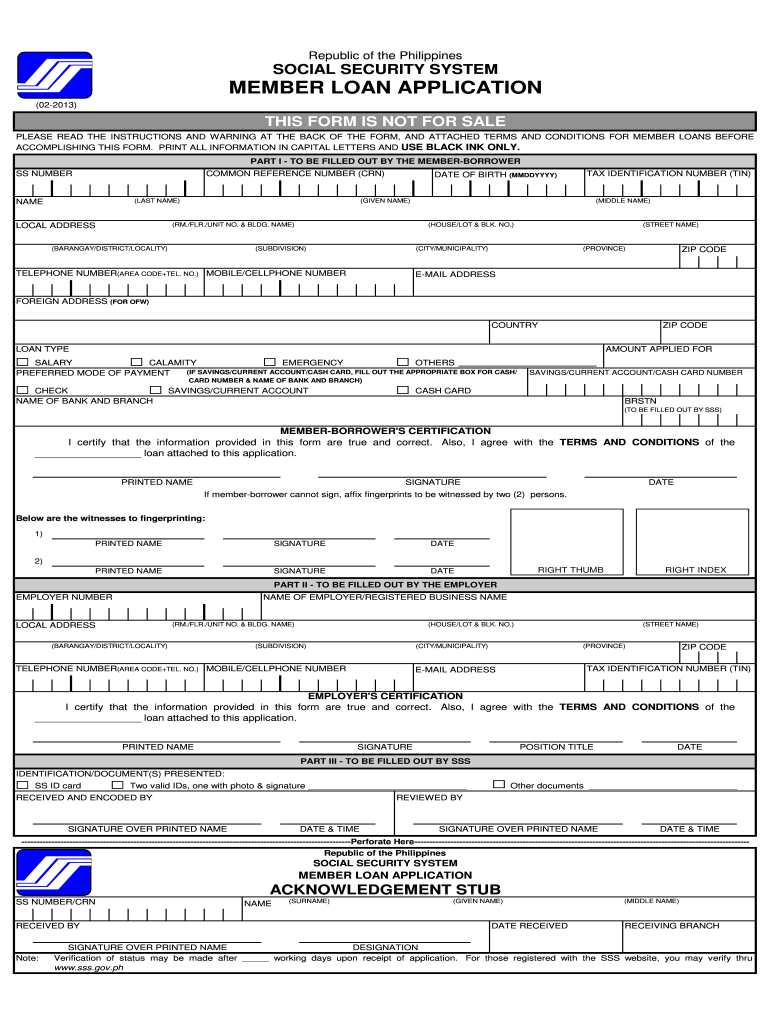

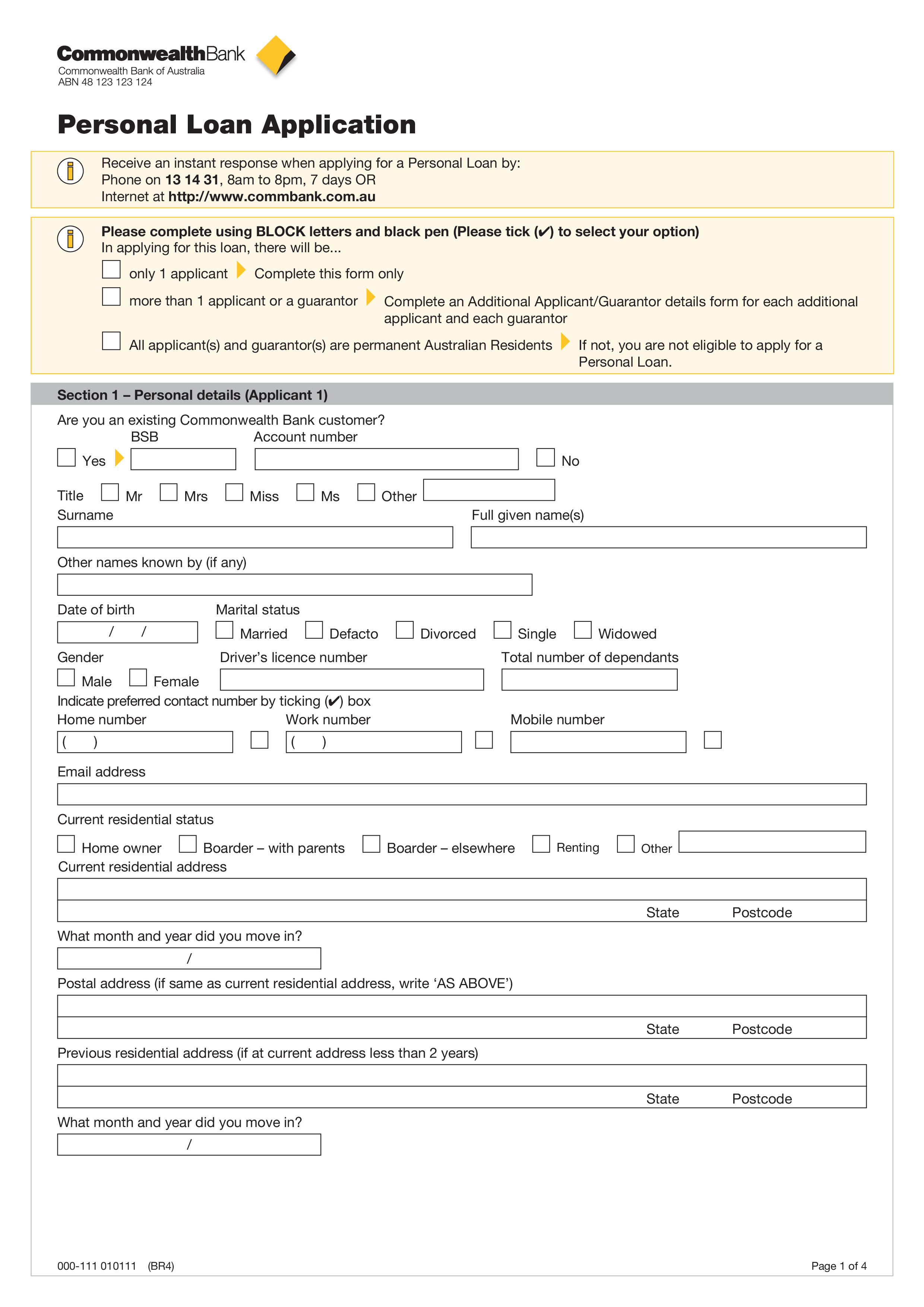

Lenders need to know that you can realistically afford the payments, so showing proof of income is crucial.

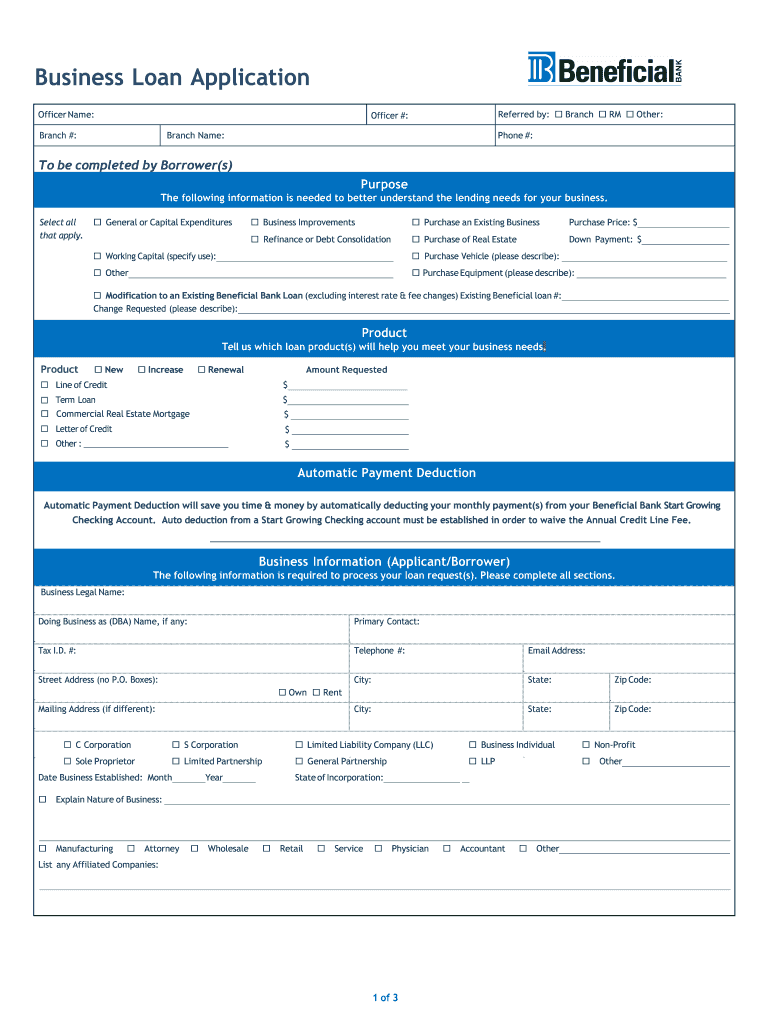

How to apply for a loan online. Best online loans for excellent credit. Compare personal loan rates from top lenders. You can get a personal loan from $1,000 to $50,000⁵.

Here are 14 lenders for you. That's also down from the $105.4 billion it was just months previously. However, getting approved for one can require good credit, and rates can get high, so it’s important to compare lenders when you’re applying for a personal loan.

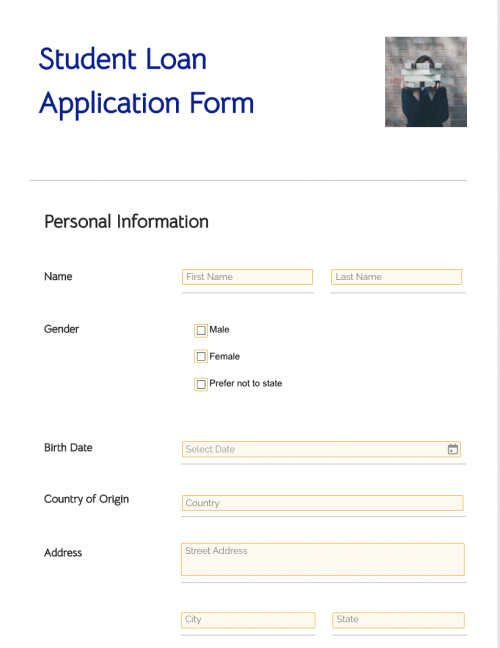

An email went out this morning to some student loan borrowers basically saying, you're debt free. It’s a good idea to figure out how much you can afford to borrow before you take on new debt. How you can use your loan.

You're more than your credit score—our model looks at factors such as your education⁴ and employment to help you get a rate you deserve. Most personal loan lenders require good to excellent credit — a good credit score is usually considered to be 670 or higher. The biden administration announced that the education department has approved $1.2 billion in student loan forgiveness for more than 150,000 borrowers.

From $3,000 to $100,000 and terms from 12 to 84 months. Best for larger loan amounts: Check whether you qualify for a bank loan.

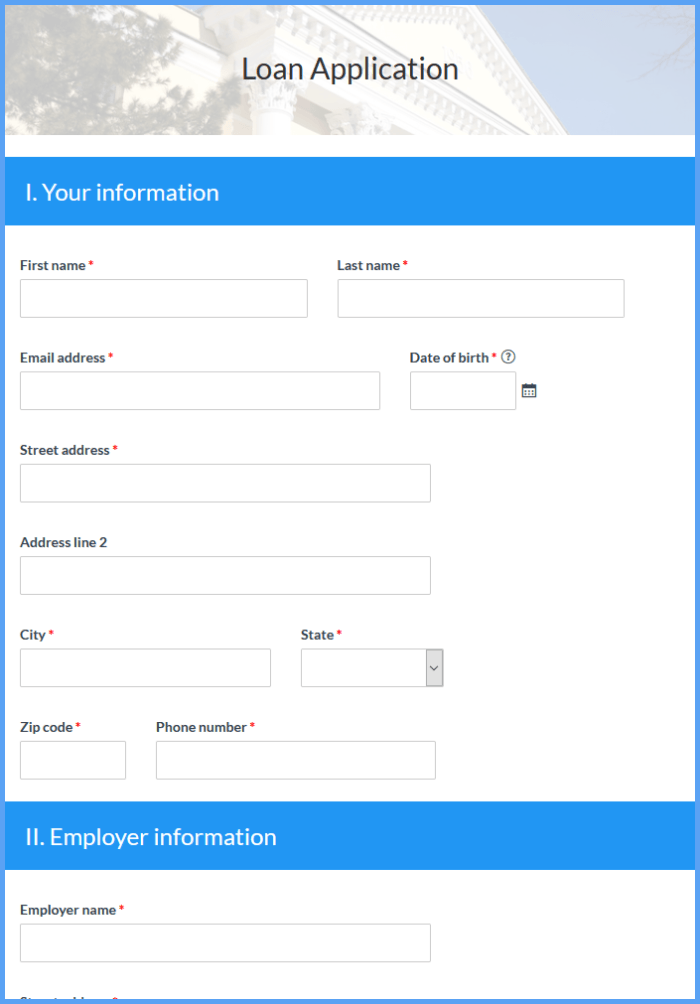

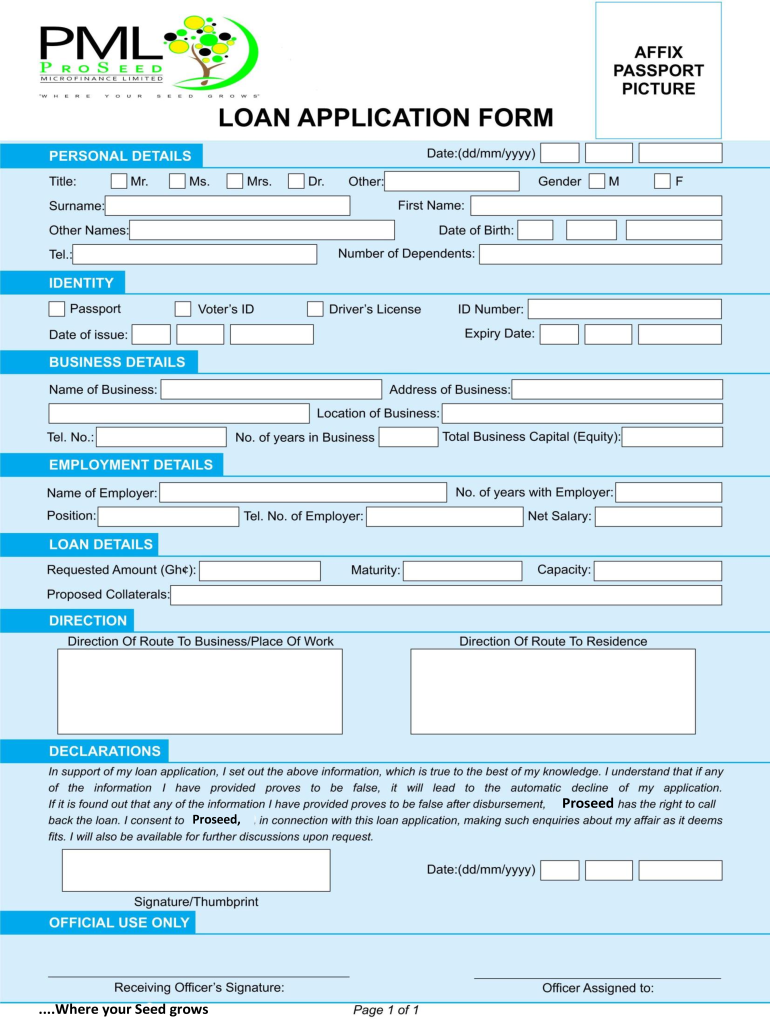

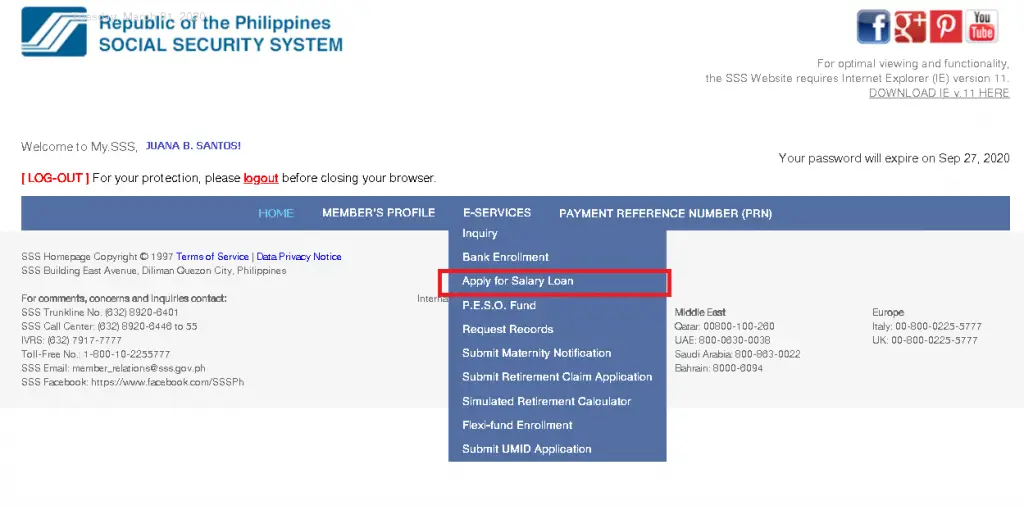

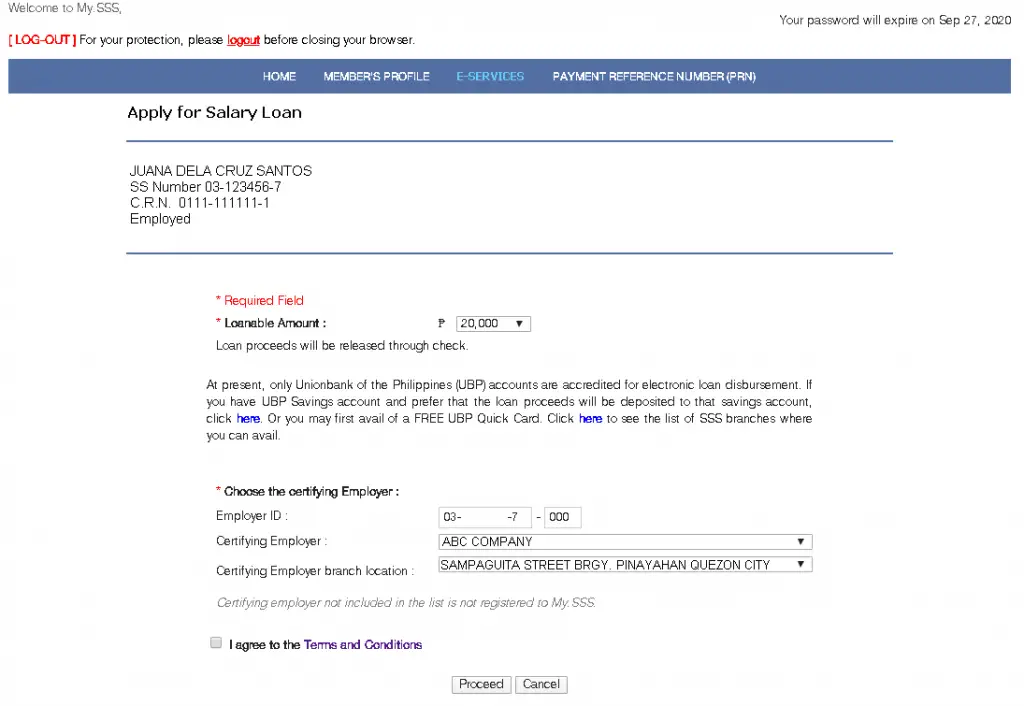

Compare personal loan rates in 2 minutes with credible.com. Submit your application for a bank loan. How to apply for a personal loan:

However, some personal loans are designed to cover specific purchases. Simple and secure online process. Select a lender and complete your application.

For those with poor credit — reflected by a score of 619 or lower — large banks charged a median rate of more than 28 percent, compared with about 21 percent at small banks. The application process for online personal loans is typically conducted over the internet. Here are the common steps in the process.

This includes direct loans, federal family education loans (ffel) and perkins loans but does not include private loan debt. It offers a variety of loan terms, loan types and special programs for buying a home and. We'll show you the loan options you qualify for, and you'll be able to choose the amount, term, and rate that best fit your needs.

Before you apply for an online personal loan, you’ll want to get a sense of your credit score and credit history. Borrowers can complete applications, submit documents, and receive approvals electronically. Personal loans are a common type of financing that borrowers can use for a wide range of purposes.