Real Tips About How To Get Out Of Debt Collection

Lenders will see you as unlikely to pay your debts, and thus your chances.

How to get out of debt collection. When you have a debt in collections, it can hurt your credit score. Send a dispute letter to the debt collector within 30 days of them contacting you. The irs is sending out what it calls an lt38 notice to let you know that during the pandemic some collection notices were suspended.

You can set up a payment plan, settle your debt or pay it off in full. If you can't afford to pay anything, call the national debt helpline on 1800 007 007 for free,. Know your rights step 2:

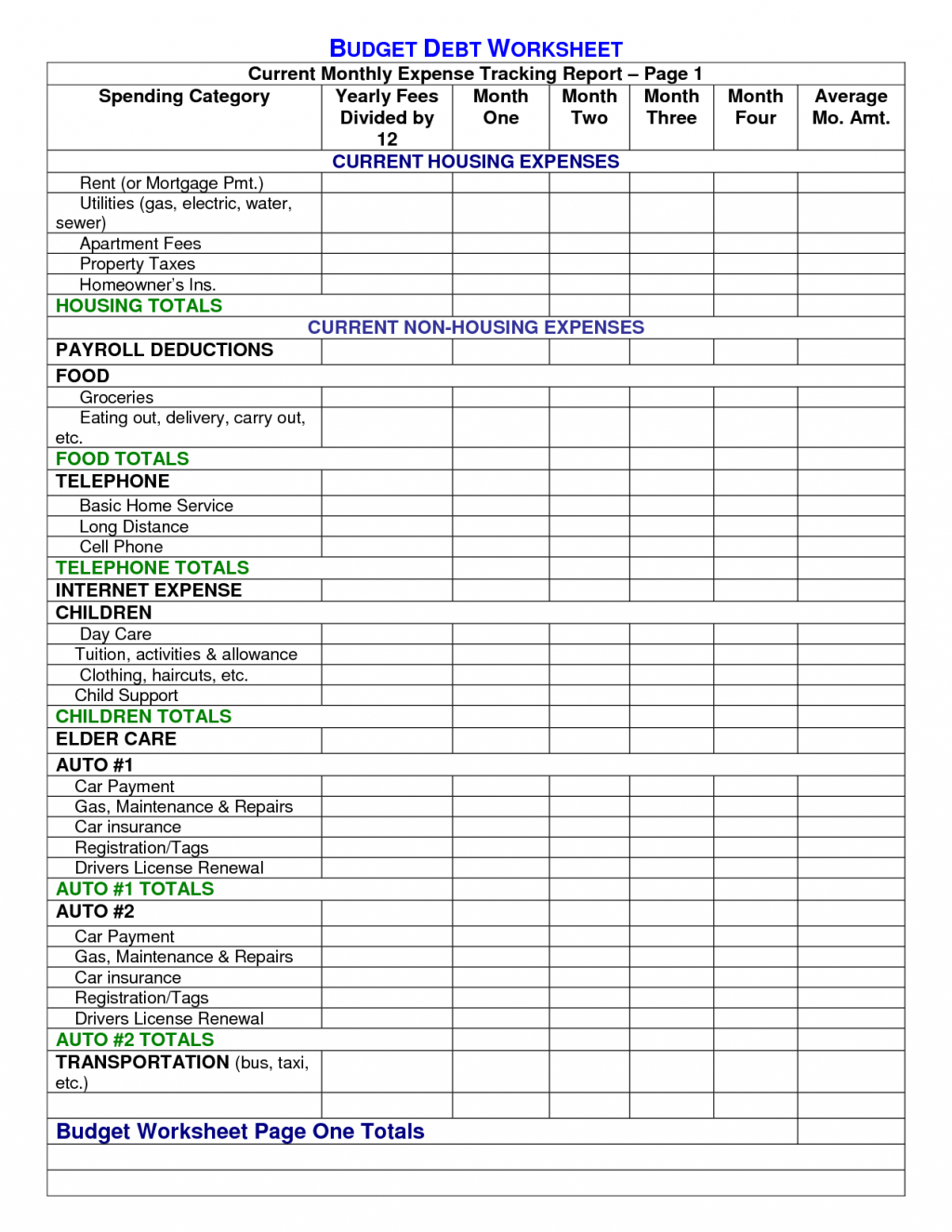

Respond to the debt collector or collection agency step 3: Calculate your income and expenses to work out how much, if anything, is left over. Basics why a debt collector is contacting you a debt collector may be trying to contact you because a creditor believes you are past due on the payments you owe on a debt.

Assess your debt & make a plan. Unpaid collections typically remain on your credit report for 7 years from the date of the first delinquency. It’s always wise to seek legal representation when someone sues you.

Having to choose between paying your bills or saving for an emergency fund is an indicator that you may qualify for credit card debt forgiveness. Once a debt collector receives a dispute letter, they must stop trying to collect. The first step to solving any problem is to acknowledge it fully.

Here's how to pay off a debt in collections: Get the agreement in writing. Keep notes of all your communications with the debt collectors, noting who you spoke with and details about the conversation.

Ask for a goodwill deletion. You have the right to ask debt. The fair debt collection practices act outlines what debt collectors can and cannot do.

Learn how to remove a collections account from your credit report by disputing the error, asking for a goodwill deletion or confirming the change. Verify the debt step 4:. If a credit card company or debt collector files a lawsuit against.

This isn't a letter to. If you have a paid collection listed on your report, you can simply ask the debt collector or original collector to remove the. The fair debt collection practices act (fdcpa) sets rules on how and when debt collectors can contact you.

According to debt.org, there are three phases to debt collection: The first step is to verify the debt's. After this period, they are removed from the report, but the actual debt may.